Big Picture of Medicare

What is Medicare?

Medicare is the health insurance system created for those age 65 and above. Coverage is also available to those on Social Security Disability (must be on for 2 years) and End Stage Renal Disease (ESRD).

When should you enroll?

If you are already receiving Social Security benefits, you will be automatically enrolled prior to your 65th birthday.

If you are not receiving SS benefits and are not covered by a group plan you should enroll in Medicare Parts A and B prior to turning 65.

If you are on a group plan, it depends. If your company has less than 20 employees, you should enroll prior to turning 65

If your company has 20 or more employees and you intend to keep your group coverage, you should NOT elect Medicare Part B. There is not a downside to electing Medicare Part A but you may wish to have a discussion with either your HR department or your insurance company (or both).

What are these Medicare Parts and Plans, it’s so confusing.

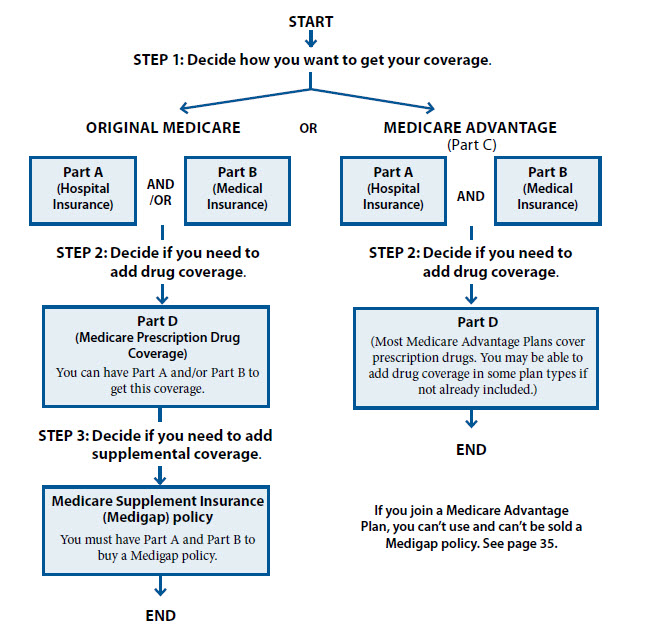

Medicare itself consists of Parts: Part A, Part B, Part C and Part D. The Medicare Plans you read or hear about refer to Medicare supplement plans. We’ll discuss those later. So let’s discuss the Medicare Parts from a 30,000′ perspective. Very simply:

Part A – Inpatient coverage (what happens in the hospital), skilled nursing facility. hospice and home health care. Part A covers 100% of in-patient expense after meeting a $1340 per admittance deductible.

Part B – Outpatient coverage. Costs incurred from doctor and urgent care visits, x-rays, MRI’s and other hi-tech imaging, outpatient physical therapy. It also covers durable medical expenses and home health care. Part B has a $183 annual deductible and then covers 80% of out patient expenses.

Part D – Medicare Drug plan. This is where you get your prescription drug coverage. Unlike Part A and B which are government run programs, Part D plans are offered by private insurance companies

I’m sure you noticed I missed Medicare Part C. Part C, most commonly known as Medicare Advantage is when you assign your Medicare coverage to a Private insurance company. There are many Medicare Advantage providers. Common providers in Colorado include Kaiser, United Healthcare, Humana and Bright Health (Denver area). Medicare Advantage plans must offer coverage equivalent to Medicare Part A and Part B. Most, but not all Medicare Advantage plans also include drug coverage.

When you are done enrolling in Medicare (and no longer have group coverage), the final configurations can be as follows:

- Original Medicare: Part A, Part B and Part D <— NOT a recommended option

- Original Medicare: Part A, Part B, Part D plus a Medicare Supplement

- Medicare Advantage (MA) plus Part D

- Medicare Advantage with a drug plan (MAPD)

The CMS Choosing a Medigap Policy booklet details this graphically as shown below:

Note, there can be some additional options for lower income enrollees that may be eligible for Medicaid as well. This is not discussed here.

What does Medicare cost?

- Part A is at no cost

- Part B is currently (2018) $134/mo (note you pay this even if you enroll in a Medicare Advantage plan) *

- Part D: Variable cost, price ranges from $20 – $60+ per month depending on the company, drug formulary and other nuances *

- Part C: Variable cost, depending on the company and the plan. There are plans available at no cost (remember you will continue to pay the monthly Part B premium)

- Medicare Supplements – Typically you enroll in a Medicare supplement if you elect the original Medicare path. Supplements come in a variety of flavors and pricing also can vary based on location and gender. A broad price range for the most popular supplements is $80 – $135 per month.

* Part B and Part D premiums are income dependent and will be higher for high income earners.

What’s best for me, Original Medicare plus a supplement or Medicare Advantage?